14.0 The SOF-To-Service Transition Model

If you haven't done work with SOCOM, this is probably all new to you. But there's a lot of different facets and sort of features wrapped up in this whole thing. A lot of folks have heard about special operations. A lot of folks have interest in selling to special operations and SOCOM, they've heard that SOCOM has its own budget. They have their own acquisition authority. They can do some of their own purchasing. There's a lot that goes into that.

I am specifically not going to use particular names and particular units because I'm not sure where the security classification guide is now, but all of the words that I'm using in this conversation are completely unclassified. They are not controlled unclassified information. They are not classified information. These all came out of completely unclassified documents that are published by the Department of Defense. So that's my upfront disclaimer.

Theater SOF is your Green Berets, your Air Force JTACs and PJs, your Navy SEALs, your Marine Corps Raiders, right? These are the theater special operations forces that are allocated, as we've talked about in the past, they're allocated to the theater special operations commands, the TSOCs, right? There is a theater special operations command for each one of the geographic combatant commands, the GCCs. So CENTCOM has SOCCENT for the Middle East, EUCOM has SOCEUR for Europe, INDOPACOM has SOCPAC for the PACOM AOR. So the theater special operations forces, when they go to war, when they go do their things, they fall under the operational authorities of those theater special operations commands. So if Green Berets go over to Poland, they are under the authorities of SOCEUR, which is the theater special operations command that provides special operations support to the combatant command, SOF support to European command.

National SOF, as it sounds, their command authority comes down the national chains.

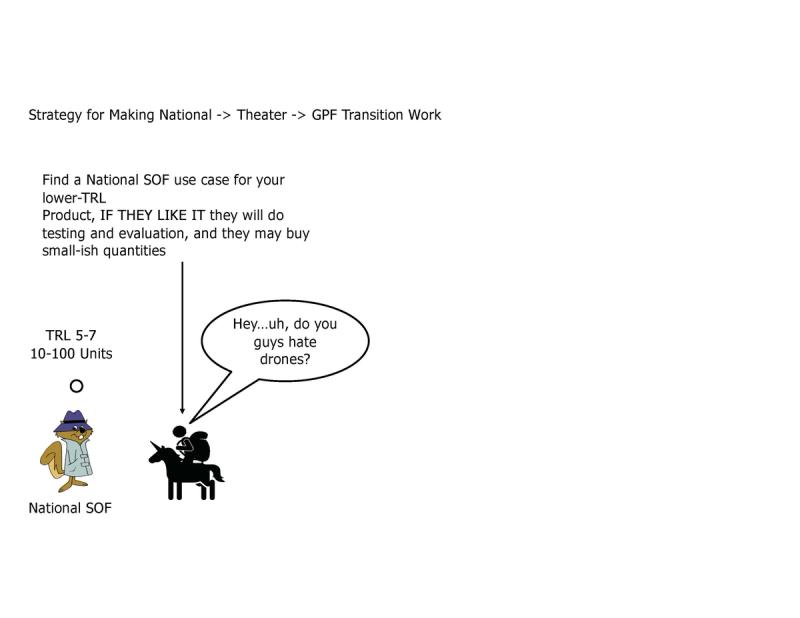

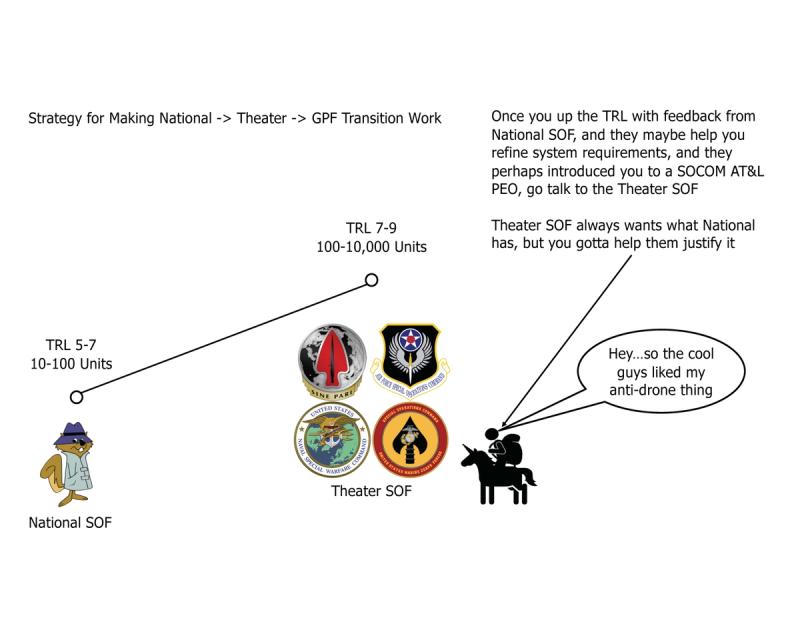

What we are going to talk about is how there is a process, there is a beaten path, if you will, of transitioning capabilities from national SOF to theater SOF. It's actually referred to by SOCOM documents as N2T, national to theater transition of technology. And there's also SOF peculiar, so SOF specific to service common, right? To transition of capabilities from special operations to general purpose forces. This is another known and well-beaten path that has been successful in the past, okay? So this is what we're going to talk about. This is a approach, this is an approach to transitioning technology. If you're interested in selling to SOCOM, it's great. You should know about how this path works.

National SOF has the capability of buying stuff. Typically they can buy stuff at a lower technology readiness level than theater SOF. They are also going to buy fewer of them because there's just fewer national SOF folks. National SOF has a very particular mission. Again, I'm not going to talk about that.

But if there's a capability that they need for their mission sets, if they identify that they need your capability for their mission sets, then they have the ability to more quickly buy those things and use them for their missions. If theater SOF subsequently identifies that they have a requirement, they have a need for those things that national SOF has been using, then theater SOF can then buy them much more quickly because national SOF has bought them.

National SOF also have kind of a small-ish budget. They can buy, try and decide. They might buy five different versions of a thing. They might buy the same thing from a couple of different companies. They might buy a radio from company A and a radio from company B and see which one works better. Whereas the theater SOF folks and the general purpose forces don't have the ability to move that quickly. They also have a lot of power in general terms over the dollars that are spent down in Tampa and they have some pretty decent clout on the Hill. So if they need something and there isn't money for it, they have ways of getting that money. So the bottom line foot stomp here is if they want your thing, generally they can get your thing, which is great, right? If you're trying to break in, that's a great avenue for a lot of early stage things.

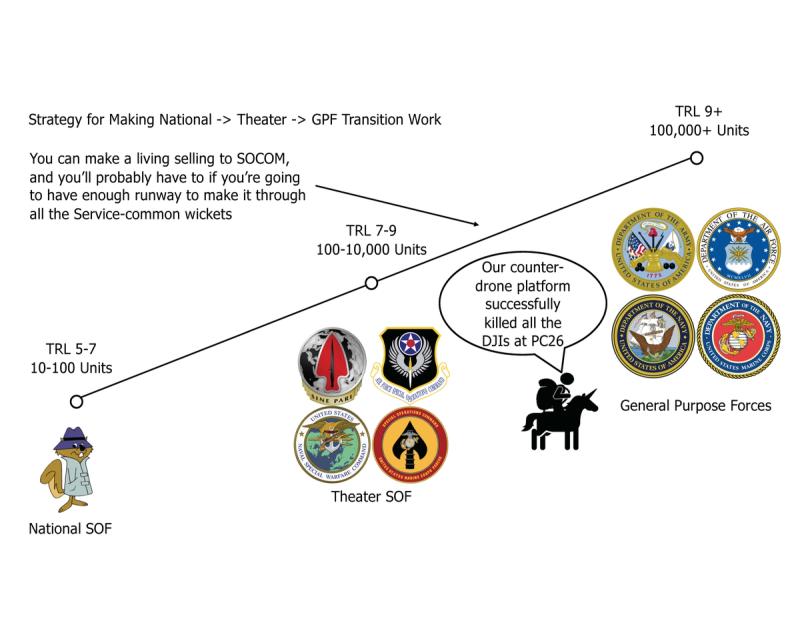

This is kind of the long process. This is starting from national, where they will buy something that is low TRL, moving into theater SOF, where they want it to be higher TRL, they'll buy more of them. And then once that mission, once that capability has become kind of ingrained across multiple services, it can become service common. Here's an important fact, SOCOM likes it when things go from being SOF peculiar to service common, because then the services will buy it for SOCOM, and SOCOM can then save their money for other stuff.

Crye precision multi cam camouflage went all the way through the process. It started out in national SOF, moved into theater SOF, and now general purpose forces are wearing that camouflage. Took a long time, but it went all the way through.

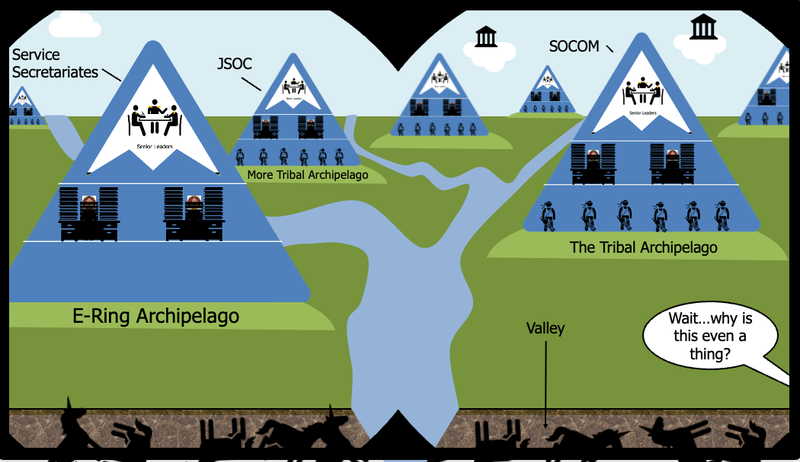

So why does this all exist? Why are these different archipelagos, well the fact is it comes down, as usual, to money.

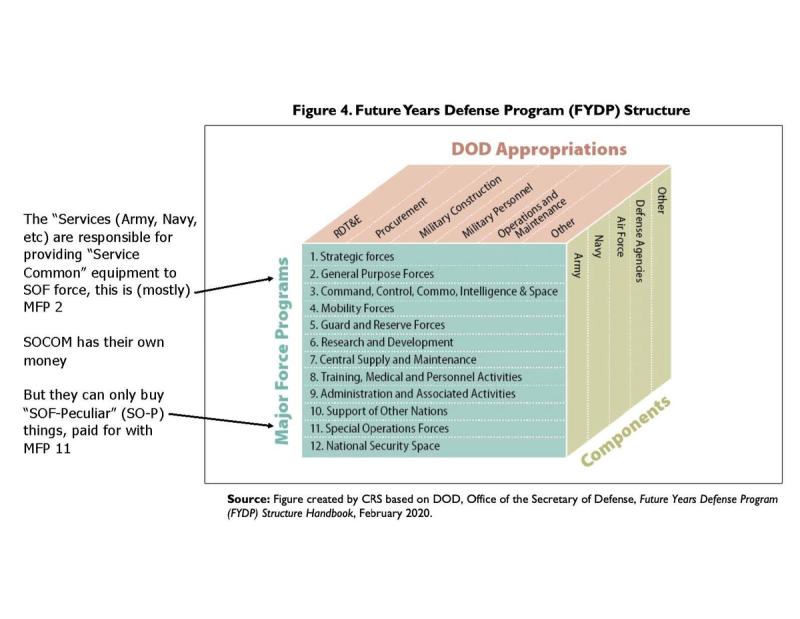

There are major force programs, this is how money is allocated. You have different colors of money, RDT&E, procurement, MILCON, MILPERS, O&M, and we talked about that in the past. You've got those different types of appropriations. They are allocated to the different services, Army, Navy, Air Force, Marine Corps, et cetera. But the programs fall within those MFPs, those major force programs. So if you're doing RDT&E, that is a MFP6 funding line. If you're doing, providing capabilities for general purpose forces, if you're selling boots or sunglasses or uniforms or Humvee trucks, generally, that's going to be MFP2. That is general purpose force capabilities.

Special operations, SOCOM specifically, has what they call MFP11. Major force program 11, and those MFP11 dollars can only be spent on things that are SOF-peculiar, they have to be unique to a special operations mission or else SOCOM is not allowed to spend those dollars.

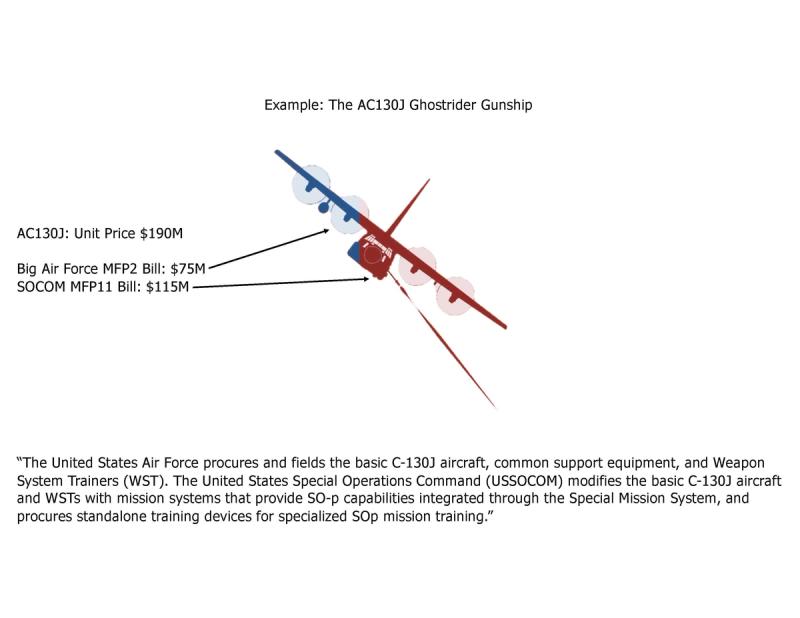

Take the AC-130 Ghost Rider gunship. This is an AC-130, we've all seen this, right? The Spooky or the Ghost Rider, whatever, the AC-130J is the most recent version. It is fundamentally an AC-130, or a C-130, a cargo aircraft.

So what they do is the Air Force buys C-130s for the entire Air Force. Everyone who needs C-130s across the entire Air Force to include Air Force Special Operations Command, everyone gets C-130s. The C-130 program office in the Air Force buys all the C-130s. SOCOM does not buy C-130s. They're not allowed to buy C-130s because a C-130 cargo aircraft is not unique to SOCOM. It is not a SOCOM unique requirement. They don't have a special need for C-130s. What they have a special need for is a targeting computer and howitzer and a 20 millimeter gun and a fueling, you know, stab so they can do in-flight refueling. All those things are SOF unique, those only have to be added to the aircraft for SOCOM missions because only SOCOM uses C-130s to shoot things from the sky.

So that AC-130, the SOF-peculiar modifications to the C-130 is what SOCOM is allowed to buy. And interestingly enough, if you look at the unit price, the Air Force part of that is about $75 million for a C-130J. The other $115 million is paid for by SOCOM. So the MFP-11 enhancements to the based aircraft are more expensive than the bird.

Now imagine if the Air Force decided that they wanted to make AC-130s common across the entire Air Force and made that a big Air Force program, SOCOM would no longer be able to buy and modify those planes. That would then become a service common capability, that would be a SOF to Service transition because Air Force, big Air Force would then have the requirement and then the responsibility of buying that entire plane and then providing it to SOCOM

So how does this look? Step one, you go to the national SOF, I'm not going to talk about who they are, I'm not going to tell you how to find them, they're around, they go to innovation events, they go to collider events. They are getting more involved in outreach efforts and engagement. So they are out there.

The most sort of surefire way to find them and get connected to them, sorry to say, is like, know somebody who came from one of those elements or hire somebody who came from one of those elements, fortunately. It's a pretty tight knit community. So breaking in from the outside is not the easiest thing, is what it is.

But here's the thing. They will take relatively low technology readiness level capabilities, right? So TRL level five to seven-ish, they're kind of happy to prototype with. They're not going to buy a lot of them though.

Even if they're doing buy, try, decide, there's just not that many bodies there. So they might buy tens or hundreds. They're not necessarily going to buy thousands.

There's just not that much need. But that's okay if they're willing to put some money on buying your early stage product and put money on it so that you can raise the TRL and give you the insights and feedback from their tests and evaluations. That's a double benefit to you, okay? So when you're trying to find early operational customers, they might be a great option. And you can do that for a while, right? They've got resources. They can buy your stuff with relatively quick procurement processes.

From there, as you mature your capability, that product, you get it to a higher TRL level. SOCOM or the SOCOM components will be more interested in it. SOCOM components, you know, AFSOC, USASOC, NSW, MARSOC, they are happy to buy lower TRL things than general purpose forces. And again, they're going to buy more than national stuff. There's tens of thousands of Green Berets and Navy SEALs and Air Force PJs and Marine Corps Raiders. So they will take a slightly higher TRL thing. It doesn't necessarily have to be all the way through all the acquisition wickets. But again, they're not going to buy 100,000 units like a big Army or a big Air Force will. So again, you kind of take that to the next stage, you get their operational feedback, you sell a fair number of units to them. You can actually make a living off of selling to Theater SOF. To the big SOCOM, AT&L, PEOs, a lot of folks do.

From there, you can go through all the multiple wickets to then sell your capability into the major services. You can do that SOF to service transition. There are examples of that transition process taking place and being successful. It is going to take a lot more effort, it's going to be a lot harder. There's a lot more test evaluation, requirements development, et cetera. But this is where you're selling tens to hundreds of thousands of units, where your large economies of scale and orders of magnitude start to come in and you can really start making a serious dent.

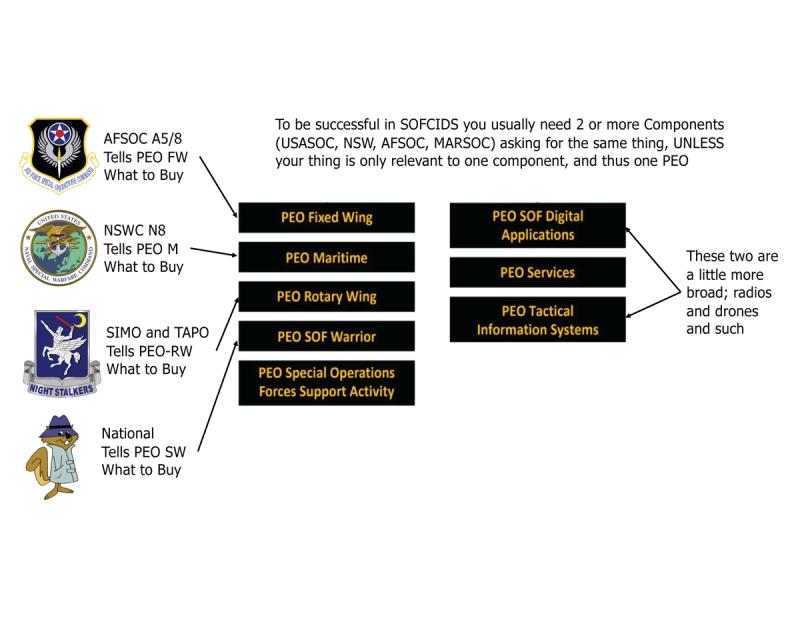

If you want to get to sell to a big SOCOM program of record, you generally have to get more than one component to support a requirement for your thing. So you got to get like Naval Special Warfare, you got to get the Navy SEALs and the Green Seals on board to buy your thing. It could be a radio, it could be a new pocket knife. You typically have to get more than one of them to agree that they need your capability. That's kind of how the SOFSIDS process works.

Except if your thing is somewhat unique. Four of the PEOs, the Program Executive Offices down in SOCOM, that are basically directly aligned with a component. PEO Fixed Wing is essentially aligned with AFSOC. So AFSOC A5/8, the folks who do the acquisition requirements development for AFSOC, more or less kind of direct and indicate what PEO Fixed Wing is going to buy.

Same thing goes for PEO Maritime. There's really no other maritime forces in SOCOM save for NSW. So Naval Special Warfare Command N8 in Coronado, more or less defines what PEO Maritime is going to buy.

Same thing goes for Rotary Wing, SIMO and TAPO in ARSOAC essentially define the requirements for what PEO Rotary Wing buys.

PEO SOF Warrior is largely dictated by what National SOF wants.

Digital applications and tactical information systems are a little bit different you've got to get a little bit more of a coalition together, but for the other ones, you can generally focus on one component to get in there.

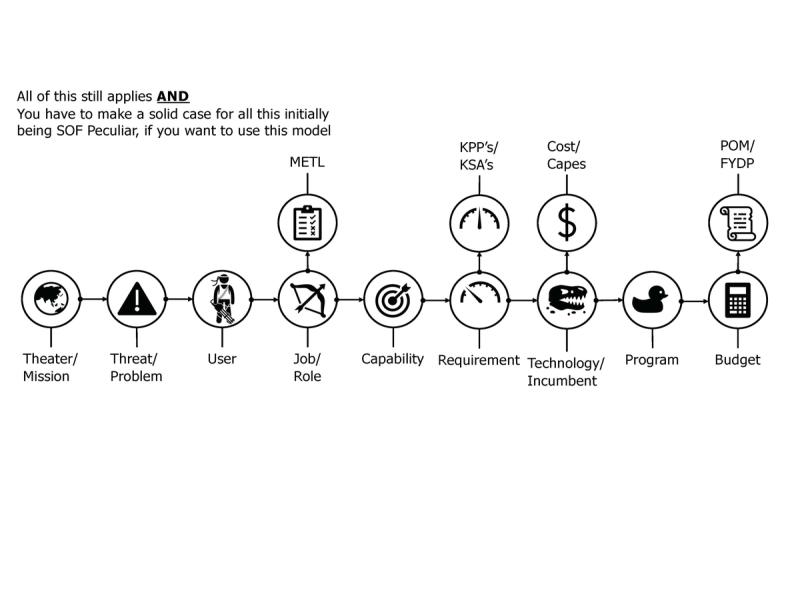

None of this special operations selling strategy stuff negates the overall go to market strategy. You have to make all of these buttons line up. You have to identify the theater, the mission, the threat, the user, the job role, the mission essential task list, and line that up with your capability. On top of that, in order to sell into SOF, you have to make a strong and defendable case that that theater, mission, threat, problem, user, and job role are SOF-peculiar. That your capability applies to a SOF-peculiar use case. If anybody, SOCOM, and SOCOM will do this litmus test because they would rather spend the Army, Navy, Air Force, Marine Corps' money on a capability they get than spend their own money.

Sign up for Rogue today!

Get started with Rogue and experience the best proposal writing tool in the industry.