Bonus Chapter: Spotting A Unicorn

If you're a VC and trying to spot a winning unicorn, we have some thoughts.

VC: "How do I know if they're a unicorn or a Shetland pony?"

Not that hard actually, it takes some lightweight due diligence, which you all love to do anyway.

First thought, there's two way to go about this:

1. "I have an equine animal in front of me, the owner is trying to sell it to me, and I need to know if it's a pony or a Pegasus"

2. "There's a thick herd of horned equine out there, how to I separate the studs from the duds?

Number 2 is harder to answer and likely has a higher upside per hour invested, so lets start there.

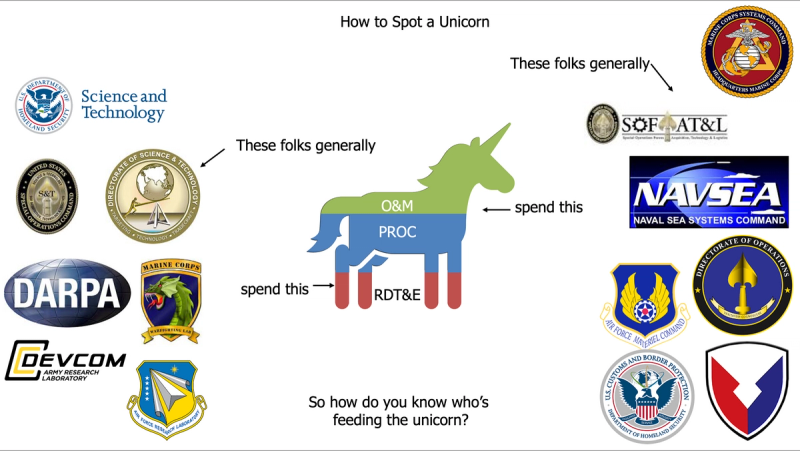

To begin with, you might do yourself a favor and learn a little about how the government actually spends money.

There are different pots, we're only going to talk about Research, Development, Test and Evalution (RDT&E), Procurement (PROC), and Operations and Maintenance (O&M).

Those colors of money are flowed like an ocean, to a river, to a stream, from a the treasury, to specific accounts, to program elements.

Different programs use different program elements, which provide different money.

Different programs, the SBIR program, R&D programs, programs of record, they use different program elements. Really large programs like the F35 Joint Strike Fighter use a range of Program Elements because they spend several different kinds of money.

If I were sizing up a unicorn, I would want to see a longitudinal trend of progression from RDT&E, to PROC, to O&M.

If your unicorn ONLY HAS RDT&E in it, chances are decent that it's still on the left hand side of the valley.

If it only has RDT&E and O&M, it may still be over there too.

None of these tips are iron clad, EVERY SINGLE program is different. That said, if you're looking for a framework, this is a decent guideline.

So where do you find these golden insights?

Public spending data.

Contract award are posted to the public (score one for democracy), DoD contracts are delayed for 90 days for OPSEC reasons.

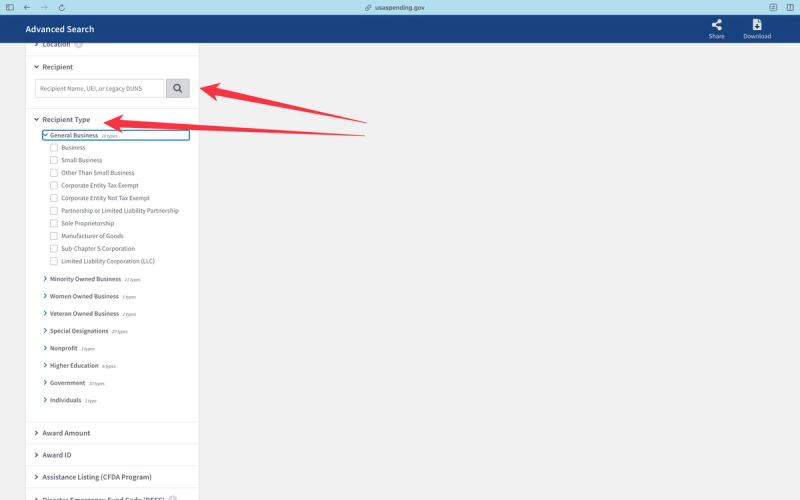

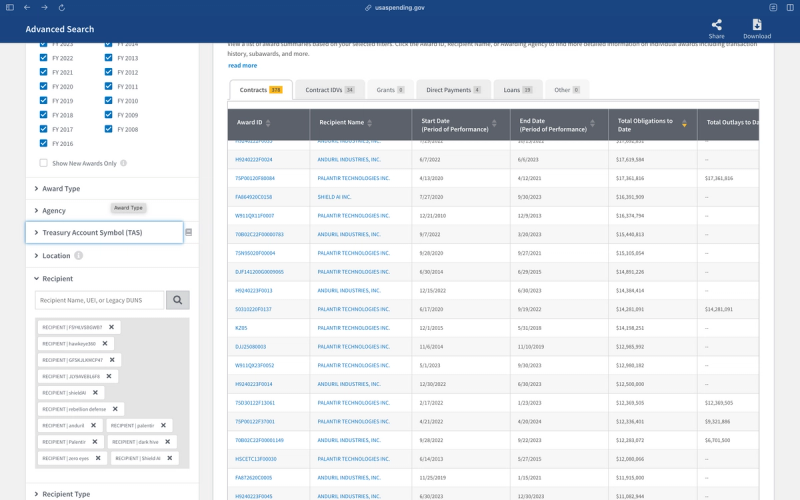

Nonetheless, if your Unicorn has been fed by a program, you can find out at usaspending.gov.

Some folks say "use sam.gov", I disagree, I think they murdered an ugly masterpiece when they rolled FPDS into sam.gov, I find the reports interface to be utterly unusable. usaspending is way more functional. But its up to you, the back end data is essentially the same.

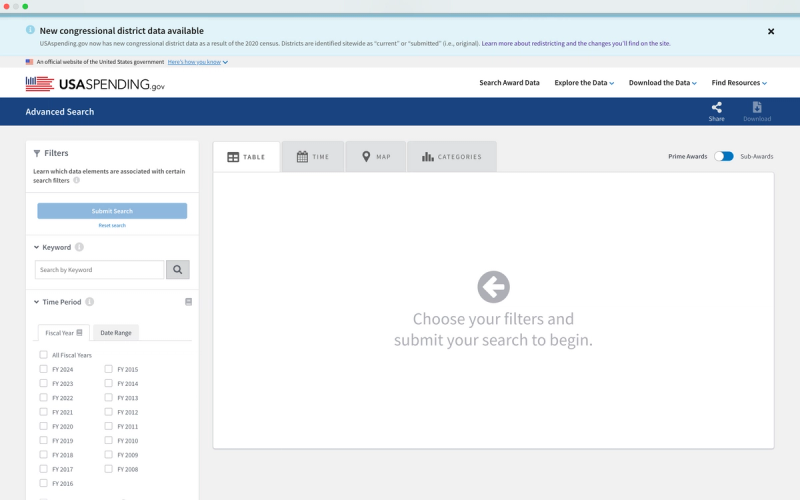

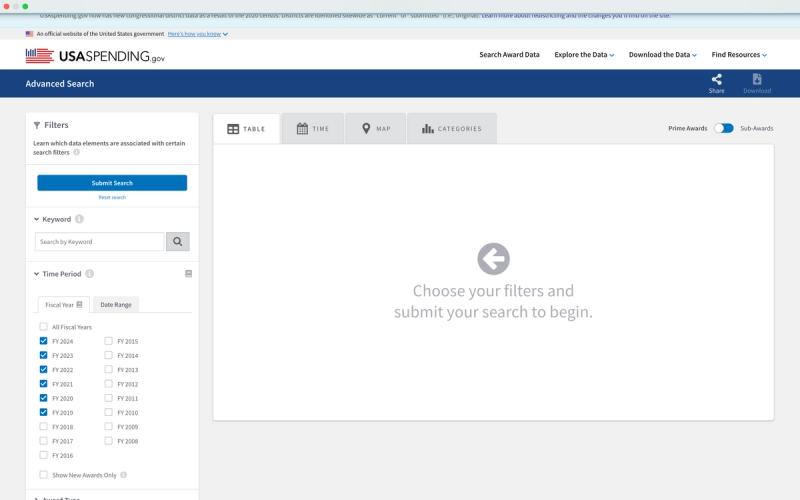

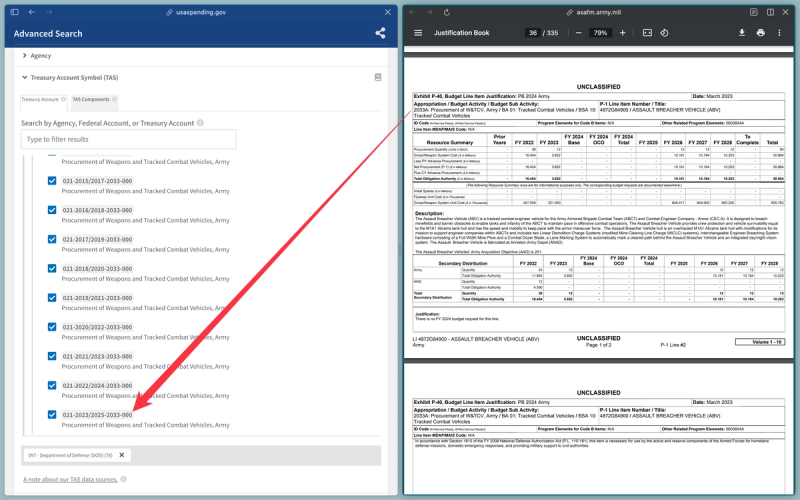

I want to do this longitudinally, so I'm going to pick several years of data.

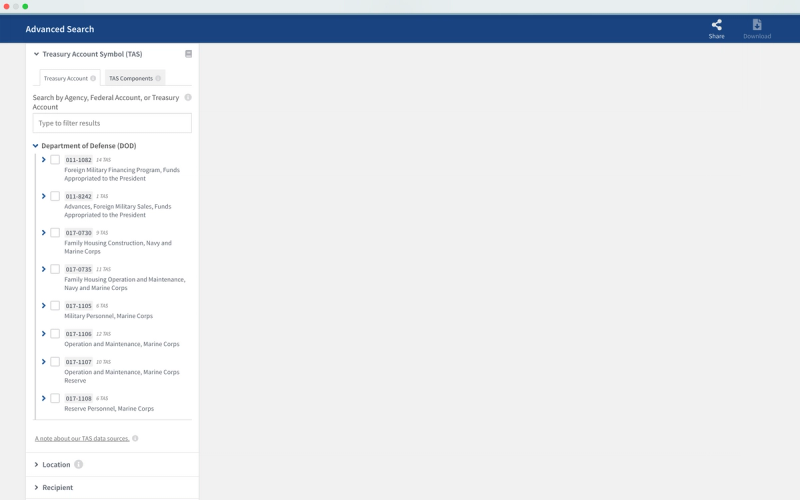

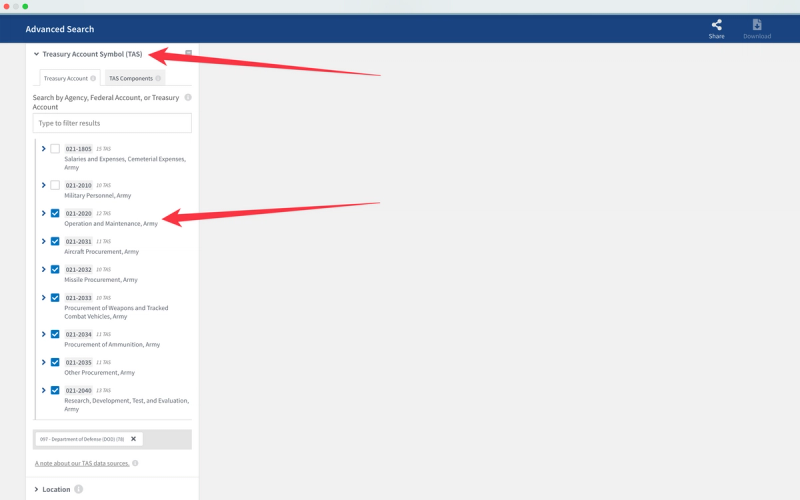

Now, lets look at the treasury account code.

The data breaks down to very granular levels, you can get all the way down to specific program lines, so you can tailor the data really tightly if you so choose. If you're casting a wider net, then use higher level lines.

Generally speaking you want to stick with RDT&E, PROC, and O&M, not MILCON, personnel, etc.

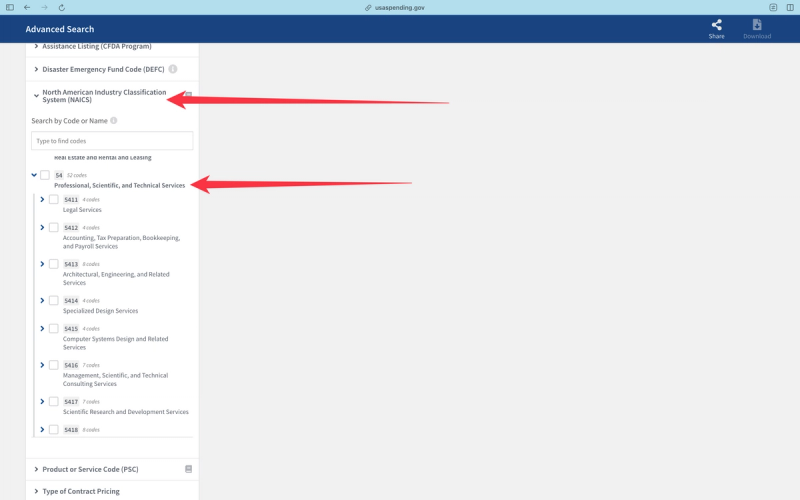

If you want to tie it down further, you can hit NAICS codes for the contracts. If a company does different things, you may want to filter out services, for instance.

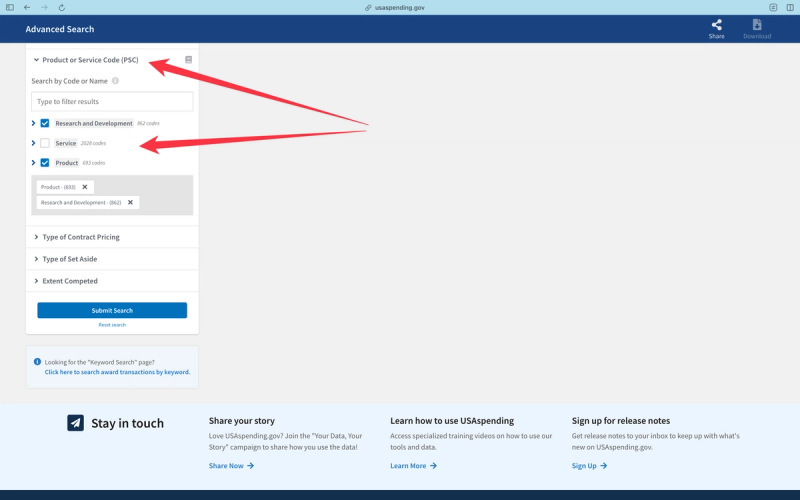

The same goes for Product Service codes.

What's the difference between NAICS and PSC codes?

Well, according to GSA:

"Sometimes, Product and Service Codes (PSCs) and NAICS can be confused with each other. We won’t go into too much detail on PSCs here, but the key difference is that NAICS codes identify the type of industry while PSCs (aptly) identify the products and services (and sometimes research and development) that the government is purchasing. NAICS would apply to widget manufacturers whereas PSC applies to the widgets."

Again, depending on how granular you want to get, you might just go with PCS codes, there's a lot of them.

If you're not sure which NAICS or PSC code to filter on (there are a lot of both) try this:

Run a report for an exemplar company/technology, like "company X got a contract from the Army for xyz, I want to find more like them"

Well, just look up their contract look at their NAICS/PSCs.

You may also want to filter by socioeconomic status.

If you're not looking for publicly traded companies or major contractors, perhaps filter by set aside, so you only get the small upstarts.

"But what about the J-Books?"

J-Books are fine and good, but once you dig into the data you'll see that there's an n-to-n relationship between programs, program elements, and contracts.

For instance, a single program like the F-35 receives funding from multiple pots of money; RDT&E, PROC, and O&M, so there's a many to one (n-1) relationship between the funding line outlined in the J-Books and the program they fund. Like there's a one to many relationship between programs and contracts. A single contract from a program could be funded with multiple program elements, so there's a one to many relationship between the program and the contract funding.

If you want to draw a line from a J-Book to a contract it is a non trivial task, I suggest you use a graph database.

Also, if you want meaningful information you need to go all the way down to the component level budget documents.

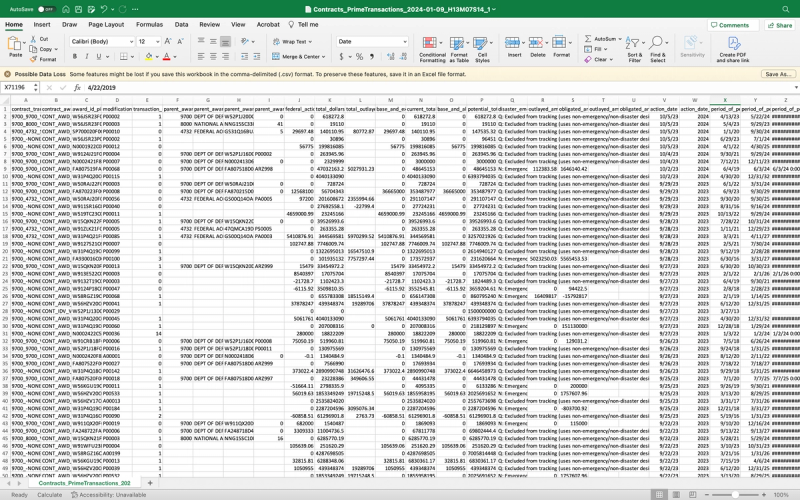

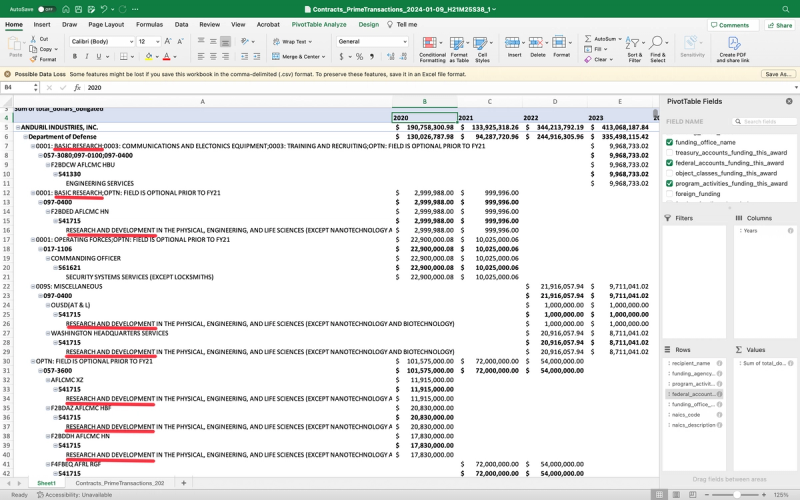

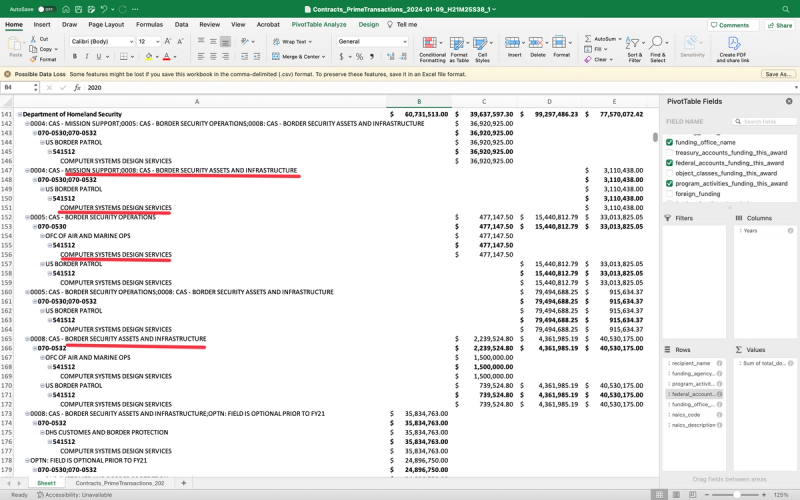

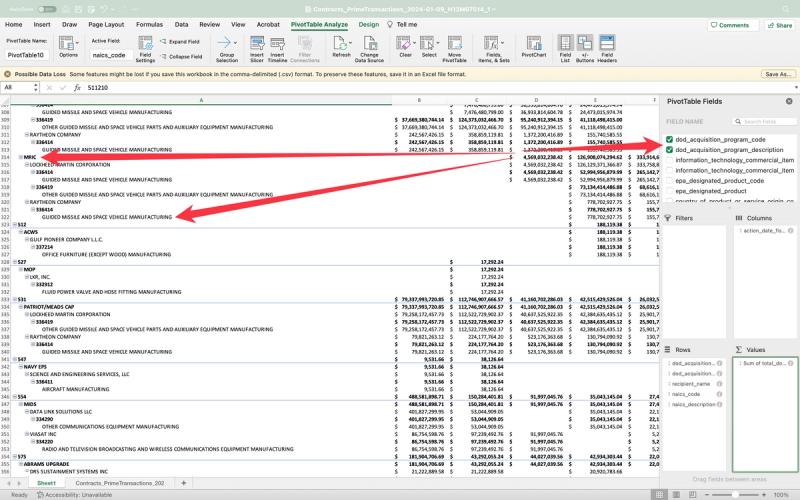

Ok, so pulled down a data dump from usaspending, we only pulled the Army PROC, RDT&E, and some O&M, its still a lot of data.

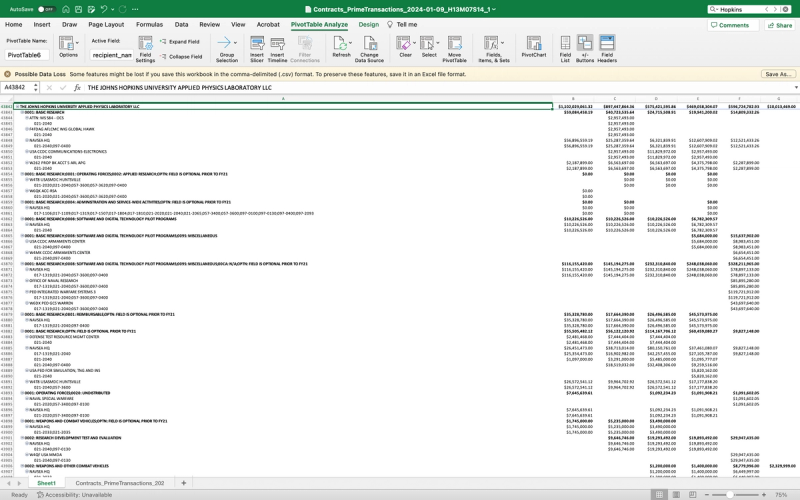

Then I pull it into a pivot table so I can sort the companies.

As you can see here, we can organize the data by treasury account, program, ordering organization, funding organization, etc.

If I want to find a good bet for a Unicorn that has a toe hold on the right hand side of the valley of death, what I would do is look for a company who has a past of receiving RDT&E funding, and then picking up increasing amounts of PROC funding, followed by O&M funding.

To pick an example, we have JHU/APL here, they have a LOT of RDT&E and even prototype funding.

But we don't have any PROC and very little O&M...

For APL that actually makes a lot of sense, they're a UARC, they can't do production contracts. But if this was a commercial company, I would see this company being firmly planted on the left hand side of the valley.

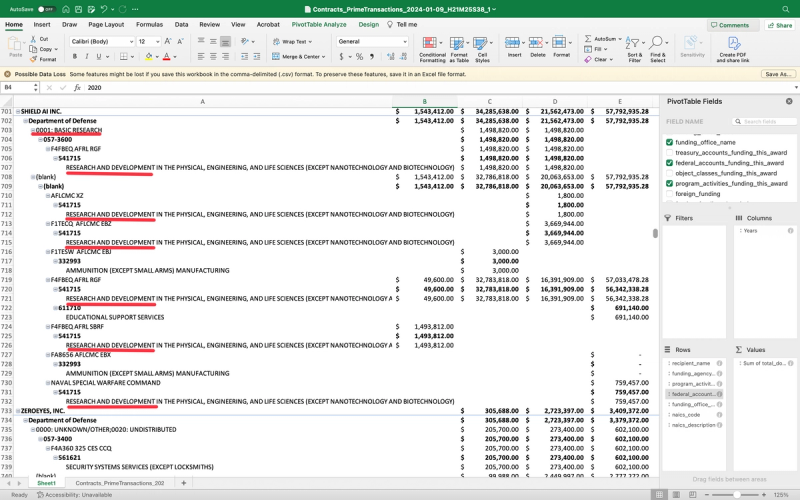

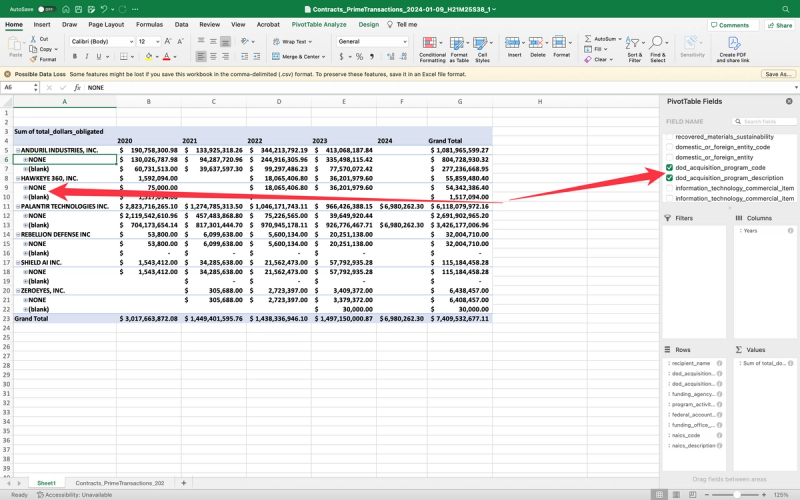

Ok, now lets go the other direction and look at the contracts of some particular unicorns

You can use the name search and/or use the Unique Entity Identifier that every SAM-registered government contractor has. Here we narrow down to some of the top DoD Unicorns.

Now, personally, if I wanted to know if my unicorn has some staying power I wouldn't want to just see the RDT&E lines, which we can sort by federal account, and then really drill in using NAICS and PSC codes.

I want to see more base-funded lines that indicate that they are delivering operationalcapabilities, not just recieving development investment.

If their contracts are mainly RDT&E then I would be asking about thier technology transition and go to market strategies.

One short cut that is useful for DoD specifically is actually the DoD Acquisition program code.

It pops right out if it is or isn't there.

This can also enable you to backwards trace to the J-Books and see what the Congressionally established program budgets are for those programs and their contracts.

Sign up for Rogue today!

Get started with Rogue and experience the best proposal writing tool in the industry.